📰 Le Fil | emlyon on its fitness trail - the Healthcare Innovation, Technology and Society institute

emlyon on its fitness trail

A new institute called the Healthcare Innovation, Technology and Society institute, or HITS, was launched at emlyon last spring to coincide with the announcement of the new strategic plan. It was an opportunity for emlyon to expand its courses and its research in the biopharma sector. This is a complex sector offering a wealth of career opportunities, providing there is a clear understanding of the specific workings of its economy and the stakes involved. The alumni shed some light.

Since taking up the school’s directorship, Isabelle Huault (PGE90) has set out to hone the school’s organization. The HITS is no exception, since it coordinates the education and research activities related  to the health sector’s core concerns. In the words of its director and professor of industrial economics Bruno Versaevel: “The HITS organization has set out to federate the healthcare activities that already exist at emlyon, along with those yet to come, in order to make them more visible and more efficient, and to do what it takes for them to operate more in tandem with each other.” In other words, the HITS encompasses both initial training programs, such as the brand-new emlyon BioPharma curriculum (cf. inset), the MSc in Health management and data intelligence, and continuing-education programs such as the one designed to spec for the Cerba Healthcare laboratory.

to the health sector’s core concerns. In the words of its director and professor of industrial economics Bruno Versaevel: “The HITS organization has set out to federate the healthcare activities that already exist at emlyon, along with those yet to come, in order to make them more visible and more efficient, and to do what it takes for them to operate more in tandem with each other.” In other words, the HITS encompasses both initial training programs, such as the brand-new emlyon BioPharma curriculum (cf. inset), the MSc in Health management and data intelligence, and continuing-education programs such as the one designed to spec for the Cerba Healthcare laboratory.

On the research front, with 15 researchers, the challenges are, here again, quite varied. “We want the HITS course to be inclusive and to tackle health issues on a large number of widely differing topics and angles,” says Bruno Versaevel. Research topics are firmly rooted in the industry’s current concerns in order to train a spotlight on HITS. Examples include the mental health of micro/SME company directors, through the Malakoff Humanis chair, the efficiency of the operational systems inside hospitals, or the application of AI tools to issues of biology or drug logistics. “It’s a word that refers back to the coordination with the incubator-accelerator. HITS will help expand its panel of experts, both externally and internally, by involving permanent faculty members,” says Bruno Versaevel.

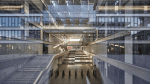

The campus’s transfer to Gerland has the added advantage of bringing emlyon, and hence the HITS, closer to a healthcare ecosystem based in Lyon, and in particular the Lyonbiopôle competitiveness hub, of which emlyon is an associate member. According to its chairman, Philippe Sans (PGE81), the role of this center of excellence in the pharmaceutical sector is to be “a catalyst of innovation. The idea is to create a fertile ground for innovation by facilitating exchanges among the 300 members, and by helping young start-ups find funding leverage”.  The HITS facility and emlyon belong there: more than one company in the sector has been founded by an alumnus.

The HITS facility and emlyon belong there: more than one company in the sector has been founded by an alumnus.  MaaT Pharma, for example, set up by Hervé Affagard (EMBA14) in 2014, is developing a cancer treatment derived from intestinal microbiota. Some start-ups have even received guidance and support from the school’s incubator-accelerator, such as ACS Biotech, founded by Pascale Hazot (MBA06) in 2012, which is working on an injectable solution for repairing damaged cartilage.

MaaT Pharma, for example, set up by Hervé Affagard (EMBA14) in 2014, is developing a cancer treatment derived from intestinal microbiota. Some start-ups have even received guidance and support from the school’s incubator-accelerator, such as ACS Biotech, founded by Pascale Hazot (MBA06) in 2012, which is working on an injectable solution for repairing damaged cartilage.

A tightly-controlled innovation process

In addition to both being part of the Lyon ecosystem, another common feature of these two start-ups is their innovation. Innovation guides many of the questions specific to the pharmaceutical industry, and its issues will be among the many focuses of the HITS’s work.  More specifically, innovation in health takes time. Anne Verzier (EMBA19), Global Brand Lead at Sanofi Vaccines, talks of “extremely long research and development (R&D) stages. We begin with a public health need, then we roll out considerable resources to develop new molecules, which will then be tested in increasingly extensive clinical trials to obtain marketing authorization”. To achieve this, the laboratories must meet increasingly demanding regulatory requirements. Philippe Sans, who has acquired decades of experience in various Institut Mérieux companies, has noted this change. “Previously, we developed a product, quickly took it to market, then tweaked it over successive versions. Today, the product must meet a stringent set of specifications in a lasting, robust manner, which imposes a framework on the R&D department,” he notes.

More specifically, innovation in health takes time. Anne Verzier (EMBA19), Global Brand Lead at Sanofi Vaccines, talks of “extremely long research and development (R&D) stages. We begin with a public health need, then we roll out considerable resources to develop new molecules, which will then be tested in increasingly extensive clinical trials to obtain marketing authorization”. To achieve this, the laboratories must meet increasingly demanding regulatory requirements. Philippe Sans, who has acquired decades of experience in various Institut Mérieux companies, has noted this change. “Previously, we developed a product, quickly took it to market, then tweaked it over successive versions. Today, the product must meet a stringent set of specifications in a lasting, robust manner, which imposes a framework on the R&D department,” he notes.

This regulatory framework, which was tightened following the PIP breast prostheses scandal, explains why it takes several years to develop a medical device or a molecule. Quentin Le Masne (EMBA22), an engineer and Doctor of Physics who has spent his career in R&D, in particular as Senior Director of medical devices at Merck, explains that “health systems are inherently conservative, for the patient’s good. Everything is constantly monitored, everything takes time, and it’s important to do it well. Because our solution will be rolled out in lots of countries, we also need to know the specific regulations.”

This regulatory framework, which was tightened following the PIP breast prostheses scandal, explains why it takes several years to develop a medical device or a molecule. Quentin Le Masne (EMBA22), an engineer and Doctor of Physics who has spent his career in R&D, in particular as Senior Director of medical devices at Merck, explains that “health systems are inherently conservative, for the patient’s good. Everything is constantly monitored, everything takes time, and it’s important to do it well. Because our solution will be rolled out in lots of countries, we also need to know the specific regulations.”

The cost of innovation

Similarly, the issue of a product’s selling price will also impact the research teams’ work. “As we work, we need to bear in mind the consequences of what we do on the product’s end price,” says Quentin Le Masne. A fact that is all the more important as innovation is increasingly costly, since it must always progress a step further. “It’s increasingly difficult to innovate in health; it takes time.  To obtain medicines, the big pharmas buy up the biotechs at a higher price, in other words, the start-ups that find the molecules, and in the end that will have a knock-on effect on the system,” says Constant Beroulle (PGE22), venture-capital investor for the Newfund Management investment fund, which operates in France and the United States. According to Philippe Sans, it can also be attributed to the need for increasingly precise treatments: “Research is focusing on medications that factor in a number of features, along with customizations. Paradoxically, no-one is trying to develop new classes of antibiotics since there is less profit to be made there than on personalized treatments.”

To obtain medicines, the big pharmas buy up the biotechs at a higher price, in other words, the start-ups that find the molecules, and in the end that will have a knock-on effect on the system,” says Constant Beroulle (PGE22), venture-capital investor for the Newfund Management investment fund, which operates in France and the United States. According to Philippe Sans, it can also be attributed to the need for increasingly precise treatments: “Research is focusing on medications that factor in a number of features, along with customizations. Paradoxically, no-one is trying to develop new classes of antibiotics since there is less profit to be made there than on personalized treatments.”

Health systems are inherently conservative, for the patient’s good. Everything is constantly monitored; everything takes time.

Hervé Affagard from MaaT Pharma is well aware of this trend. “A large part of my work consists in raising capital. In all, we have raised around 130 million euros in seven funding rounds. Before commercializing our solution, we will probably need that much money again. By way of example, for some clinical trials, each patient included costs us €100,000,” says the entrepreneur. Having his company listed on the Euronext stock exchange enabled him to open his own production plant near Lyon, which is rare in the sector. Pascale Hazot, from ACS Biotech, has also banked on retaining the company’s production plant. She even uses this plant to generate additional financing by supplying other laboratories. “We capitalized on our in-house skills in cellular therapy to offer laboratories products they needed for their own research by launching our osteo-articulatory biobank business in 2023,” she explains.

To find funding, “in the early phases, there’s love money, in other words money from friends and family: business angels. You can’t go very far on that. There is also seed funding through funds specialized in this type of financing,” explains Rodolphe Besserve (PGE00),  Managing Partner in the investment fund Arbevel Life Sciences Crossover Fund. Another solution is public support, such as Pascale Hazot was able to obtain through the Banque publique d’investissement (Bpifrance) and by successfully responding to a call for projects organized by the Eureka fund and financed by the European Commission. After that, investment funds can raise up to several dozen millions of euros; beyond that, the only solution is to become listed on the stock exchange. Depending on the country, it can seem more or less easy to find investments. “From an investment angle, the United States is more mature and more professional,” says Rodolphe Besserve. There are hundreds of industry-specific funds, whereas in France, the funds that invest are usually non-specialist ones.”

Managing Partner in the investment fund Arbevel Life Sciences Crossover Fund. Another solution is public support, such as Pascale Hazot was able to obtain through the Banque publique d’investissement (Bpifrance) and by successfully responding to a call for projects organized by the Eureka fund and financed by the European Commission. After that, investment funds can raise up to several dozen millions of euros; beyond that, the only solution is to become listed on the stock exchange. Depending on the country, it can seem more or less easy to find investments. “From an investment angle, the United States is more mature and more professional,” says Rodolphe Besserve. There are hundreds of industry-specific funds, whereas in France, the funds that invest are usually non-specialist ones.”

Paradoxically, no-one is trying to develop new classes of antibiotics since there is less profit to be made than on personalized treatments.

A crisis-proof logistics system?

Let’s not forget that the pharmaceutical industry is international, which raises issues of access and logistics since production is often offshore. Anne Bard (EMBA11), Senior Design Lead for the British multinational GSK, is responsible for the design and construction of plants to meet a new production requirement. “If we’re producing a new drug, I analyze our network of plants, their location in relation to the site where we intend to launch the treatment, and whether they have the necessary production capacity. I also have to analyze the need to build or refurbish a production plant, how much that will cost, how long it will take, etc. I don’t make the strategic choices myself, but I provide the information necessary to propose various responses to the strategic problems.” This entails striking the right balance: “We want to be close to the locations in which we’ll be selling, but we can’t be in every world region,” points out Anne Verzier from Sanofi Vaccins. “The industrial strategy helps prevent supply problems.”

Let’s not forget that the pharmaceutical industry is international, which raises issues of access and logistics since production is often offshore. Anne Bard (EMBA11), Senior Design Lead for the British multinational GSK, is responsible for the design and construction of plants to meet a new production requirement. “If we’re producing a new drug, I analyze our network of plants, their location in relation to the site where we intend to launch the treatment, and whether they have the necessary production capacity. I also have to analyze the need to build or refurbish a production plant, how much that will cost, how long it will take, etc. I don’t make the strategic choices myself, but I provide the information necessary to propose various responses to the strategic problems.” This entails striking the right balance: “We want to be close to the locations in which we’ll be selling, but we can’t be in every world region,” points out Anne Verzier from Sanofi Vaccins. “The industrial strategy helps prevent supply problems.”

But while this system works well under normal conditions, it can be derailed by a crisis such as the Covid epidemic. “We found ourselves with an absurdly inadequate supply chain that goes around the world to reach the patient, and problems of sovereignty, dependency and fragility...,” says Anne Bard. The pandemic brought to light the system’s strengths and weaknesses.  “Covid was handled exceptionally well, with unprecedented coordination within the industry. Sanofi wasn’t a vaccine manufacturer during the pandemic, but made its production plant available to Moderna and Pfizer. The regulatory authorities agreed to evaluate products under unusual circumstances, while trying to guarantee their safety and effectiveness. It was the first time that Europe had made a centralized purchase of a healthcare product, whereas the United States spent huge sums on pre-empting vaccine doses to the detriment of other countries,” recalls Martial Manti (PGE95), VP Head of Global Pricing at Ipsen.

“Covid was handled exceptionally well, with unprecedented coordination within the industry. Sanofi wasn’t a vaccine manufacturer during the pandemic, but made its production plant available to Moderna and Pfizer. The regulatory authorities agreed to evaluate products under unusual circumstances, while trying to guarantee their safety and effectiveness. It was the first time that Europe had made a centralized purchase of a healthcare product, whereas the United States spent huge sums on pre-empting vaccine doses to the detriment of other countries,” recalls Martial Manti (PGE95), VP Head of Global Pricing at Ipsen.

Healthcare, whether public or private, always comes at a price. But the notion of price in the pharmaceutical industry is very different to that in any other industry.

Access to medicines: an economic and political issue

Moreover, this decision on the part of the Americans highlights the extent to which the conditions for access to medication can vary around the world, depending on a country’s political culture, wealth and public health objectives. “Some will prioritize the protection of the youngest, or treating certain diseases: it depends on the society’s outlook,” sums up Martial Manti. “As the population ages, health systems are faced with a mechanical increase in patient numbers and in the duration of treatments. Accordingly they assess the cost/benefit ratio of a treatment to know whether a product must or may be refunded by the system, and to what degree.”

This is because healthcare, whether public or private, always comes at a price. For a public health system, this price is negotiable. “It is a quasi-commercial negotiation to strike a balance between a seller and a buyer. But the notion of price in the pharmaceutical industry is very different to that in any other industry. There are forces at work between the cost of production, the patient, the system that pays, be it private or public, and the industry that innovates and carries out the production.  In the end, the price of a medicine is the point of equilibrium between these tensions,” resumes Martial Manti. Moreover, this is why sales reps working for laboratories are tasked with meeting doctors to raise their awareness of the new medicines and devices. Before his time at emlyon, Frederick Alskayem (MS23) was a sales rep for the Danish laboratory Novo Nordisk for two years. “I was promoting an obesity drug and demonstrating it to health professionals,” he explained. A major laboratory such as Novo Nordisk has partner doctors, but in order to expand into a new therapeutic area, it will have to develop a territorial sales strategy in order to search for contacts.”

In the end, the price of a medicine is the point of equilibrium between these tensions,” resumes Martial Manti. Moreover, this is why sales reps working for laboratories are tasked with meeting doctors to raise their awareness of the new medicines and devices. Before his time at emlyon, Frederick Alskayem (MS23) was a sales rep for the Danish laboratory Novo Nordisk for two years. “I was promoting an obesity drug and demonstrating it to health professionals,” he explained. A major laboratory such as Novo Nordisk has partner doctors, but in order to expand into a new therapeutic area, it will have to develop a territorial sales strategy in order to search for contacts.”

Today, Frederick has become a senior life science consultant with the Simon-Kucher consultancy firm, providing guidance and support for pharmaceutical companies on questions of market access and digitalization. “In France, many laboratories are investing huge sums in digitalization”. Data collection from physicians and patients is not particularly optimized as yet, and digitalization will help them gain a better understanding of how to collect and protect this data.” If he has reached this point in his career, it’s thanks to his degree. “After my MS degree, I received three job offers from laboratories. The reputation and ranking of the master’s degree and of emlyon played a major role in that,” he admits. Through the HITS course, in fact, the school proposes to address the various issues facing the sector. “We are trying to embrace issues that are at once deeply personal and universal,” sums up Bruno Versaevel. “Health is our body, it’s a private affair, but we are all concerned. We are also linking up the local aspect of the Lyon ecosystem and the global aspect of manufacturing. HITS is about technology, with a very strong focus on R&D operations. But it’s also very much about society, in particular because the issues of access to innovative drugs and vaccines affect widely differing and sometimes very impoverished populations. We want to embrace these stark differences and become one of Europe’s benchmark business schools in healthcare studies.”

Health is our body, it’s a private affair, but we are all concerned.

THE BIOPHARMA CURRICULUM, A NEW SPECIALIZED COURSE

“The BioPharma course is part of the Grande Ecole Program (PGE) and is designed for learners who have at least an initial diploma in life sciences,” explains Bruno Versaevel, Head of the HITS Institute. In addition to the opportunity to spend a semester studying at the Copenhagen Business School alongside other students that have already taken scientific courses, the emlyon BioPharma curriculum provides 48 hours’ teaching on the economics of the biopharmaceutical industry in the first year of the master’s, and four courses, each 24 hours, on the specific challenges facing the pharmaceutical industry in the second year, i.e. AI, intellectual property, entrepreneurship and the economic evaluation of health products, in resonance with the activities of the Gerland biodistrict.

FINANCE PROFESSIONS IN THE PHARMACEUTICAL INDUSTRY

According to Professor Bruno Versaevel, Head of the HITS institute, “the cost of developing a new drug has doubled every nine years since 1950”. Such a booming financial ecosystem implies a wide variety of positions and roles. One of the first stages of financing concerns venture-capital, which is the domain of Constant Beroulle (PGE22) at Newfund Management. “We try to understand what the start-ups are doing and how they are managing their business,” he explains. “If the business side is satisfactory, and if they have a solid team, we invest in the company to take out shares in the capital and support its development. All it takes is for a few start-ups to do well to balance out the risk in the portfolio and for our model to be viable.”

“In venture capital, we set out to prove a technology, to show that it works and then market it,” confirms Rodolphe Besserve (PGE00), Managing Partner of the Arbevel investment fund. After the venture capital comes the development capital. “We structure a company, then let it enter the market and set up management tools, etc. Next, we either sell it or it is taken over by another fund that then assumes the next steps.” Investment bankers can help these companies become listed on the stock exchange, or undertake a merger-acquisition. When these companies are listed on the stock exchange, their fate hinges, in part, on the recommendations of the financial analysts. According to Rodolphe Besserve, their role is: “To assess the accounts of companies listed on the stock exchange with a view to issuing a recommendation to sell or to buy, and a valuation price.”

THE THRIVING HEALTH CLUB

Its missions: bring together the emlyon alumni in the health sector and build their network, contribute to the emergence of innovative projects and create professional opportunities. The emlyon health club is doing well, with lots of new members joining in September and a busy event calendar. “It’s our job to organize gatherings with our partners such as bioMérieux, along with casual afterworks and masterclasses where experts come to talk about their job field. We had one recently on AI in the medical imaging field,” says Quentin Le Masne (EMBA22), who manages the club. In December, an event on the theme of training on health will be organized on campus with the HITS. “We aim to play an active role in HITS by bringing the alumni’s voice to bear on the relevant training courses for tomorrow, and to contribute to the network’s collective expertise.”

Commentaires0

Veuillez vous connecter pour lire ou ajouter un commentaire

Articles suggérés